Mastercard Simplifies Online Purchase History

February 2, 2021 | Warsaw | By Anna MarciniakCardholders to receive access to more detailed purchase information in their banking app

Mastercard is introducing a new solution for digital banking that provides cardholders with more details on their purchases. Delivered by Ethoca, a Mastercard company, the new product will enhance consumers’ digital experiences by supplying them with additional transaction details, such as a merchant’s name, logo, and location of the purchase. Merchants are invited to upload their logos to the system in order to increase the visibility of their brand and reduce transaction confusion that leads to unnecessary chargebacks. Furthermore, Mastercard is working with issuers on introducing a new industry standard so that enriched transaction information is enabled in digital banking channels by 2022.

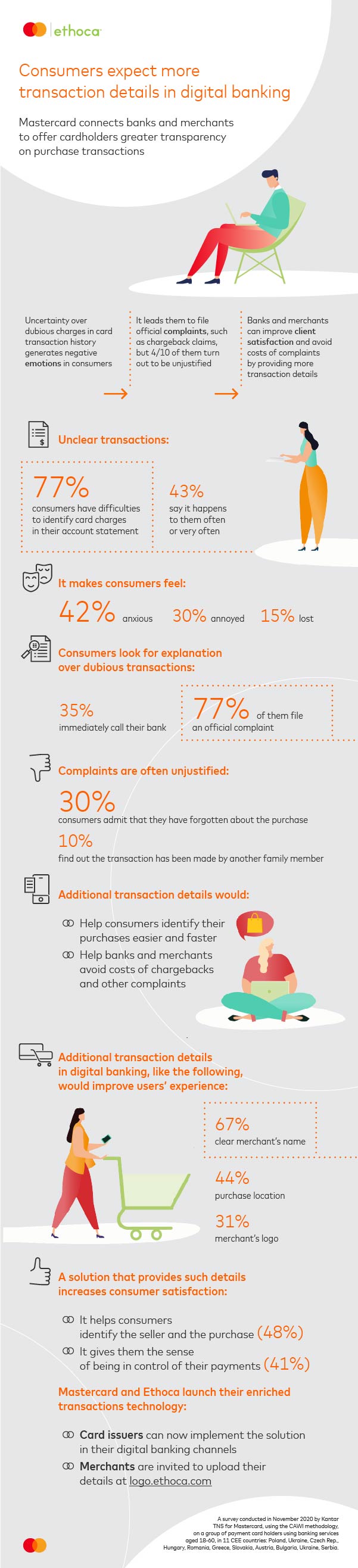

In a recent survey[1], a majority of consumers reported problems in identifying some of their transactions via digital banking channels. Anxiety over potential fraud led many consumers to file chargeback claims which could have been avoided.

We have all experienced the frustration of not being able to immediately identify charges on our statements. For example, the merchant’s name may be unrecognizable, or the payment processor’s name may be displayed instead of the merchant’s. The new opinion poll from Mastercard reveals that for many digital banking customers this is a common problem that generates negative emotions. As many as 77% respondents report that sometimes they cannot recognize purchases in their transaction history, while for almost one in five it happens often or very often. This situation makes consumers feel anxious (42%), annoyed (30%), lost (15%) and helpless (12%).

The most common reaction for a consumer who does not recognize a purchase is to immediately call their bank (35%) or, less frequently, the merchant (6%). 59% of consumers admit they were able to identify questionable transactions after some time, many – including Bulgarians, Greeks, Romanians and Ukrainians – simply call their bank first rather than try to identify the transactions themselves.

Complaints can be avoided

Calls to cardholders’ banks usually lead to the filing of complaints (77%) in the form of chargebacks. However, many of these turn out to have been unjustified. As many as 4 out of 10 of consumers discover that either they had forgotten about the purchase (30%) or it had been a transaction made by another family member (10%). However, once a chargeback claim has been filed, it needs to be resolved or closed by the issuer – which generates operating costs related to the time spent contacting a cardholder, verifying the transaction, and processing the client’s case. On average this takes up to 2 weeks.

Respondents in a survey commissioned by Mastercard confirm they want to see additional transaction details in their card transaction history to help them identify their purchases easier and faster. In their opinion the most useful details would be the merchant’s name (67%), their logo (31%) and purchase location (44%). Such enriched card transaction history would help consumers quickly identify the seller (48%) and the purchase itself (48%). But most importantly, it gives cardholders confidence and sense of control over their payment transactions (41%).

Merchants invited to upload their logos

The new Mastercard solution will help increase consumers’ satisfaction and significantly improve their user experience, as well as limit chargeback claims for issuers and merchants. By visiting logo.ethoca.com, and completing the associate form, merchants can easily upload their logo to be displayed in online and mobile banking channels. Merchants do not bear any costs to participate in this service.

Once ready, their logos will be linked to corresponding transactions in digital banking applications, adding clear visual cues to help cardholders quickly identify legitimate purchases. For merchants this is an opportunity not only to minimize expensive and time-consuming chargebacks, but also to extend their brand presence and recognition.

“We are committed to work with issuers and merchants to make this functionality a standard for digital banking users by 2022. We believe that greater transaction transparency significantly improves digital banking channels’ user experience, gives consumers peace of mind and sense of control over their spending. From issuers’ point of view, it increases cardholders’ interactions with bank’s digital channels, and merchants will get enhanced brand’s visibility. Also, both banks and merchants would benefit from lower volume of consumers’ calls and complaints” – says Brian Morris, Vice President, Product Development for CEE, at Mastercard Europe.

The new Mastercard solution is particularly relevant in the digital era, where the popularity of online and mobile banking is growing at an unprecedented rate. Today, these are already the primary channels of contact for banks’ clients, with 60% of consumers using digital banking services more than once a week and 24% at least once a day, as declared in the survey. Respondents appreciate digital banking channels for the time savings (69%), the ability to access anywhere and anytime (65%), for better control over transactions (55%) as well as their easy-to-use and convenient tools to manage finances (47%). Digital advancement (58%) is also one of top 3 criteria while choosing a bank, next to its credibility (63%) and the financial benefits associated with its offer (59%).

[1] The survey conducted in November 2020 by Kantar TNS for Mastercard, using the CAWI methodology, on banked consumers age 18-60, payment cardholders, in CEE countries: Austria, Bulgaria, Czech Rep., Greece, Hungary, Poland, Romania, Serbia, Slovakia, Ukraine.

About Ethoca

Ethoca is an award-winning provider of collaboration-based intelligence and technology solutions that empower businesses around the world to fight fraud, prevent disputes and improve the customer experience. Powered by the ever-growing Ethoca Network, our solutions provide rich intelligence throughout the customer purchase journey and close costly communication gaps between all stakeholders in the payments ecosystem. These include thousands of the world’s biggest ecommerce brands, the largest banks, service providers and consumers. For the first time, fraud, customer dispute and purchase insights are now available and actionable in real time – delivering significant revenue growth and cost saving opportunities for all. Ethoca was acquired by Mastercard in April 2019. To learn more, please visit www.ethoca.com

About Mastercard (NYSE: MA)

Mastercard powers economies and empowers people in 200+ countries and territories worldwide. Together with our customers, we’re building a sustainable economy where everyone can prosper. We support a wide range of digital payments choices, making transactions secure, simple, smart and accessible. Our technology and innovation, partnerships and networks combine to deliver a unique set of products and services that help people, businesses and governments realize their greatest potential.