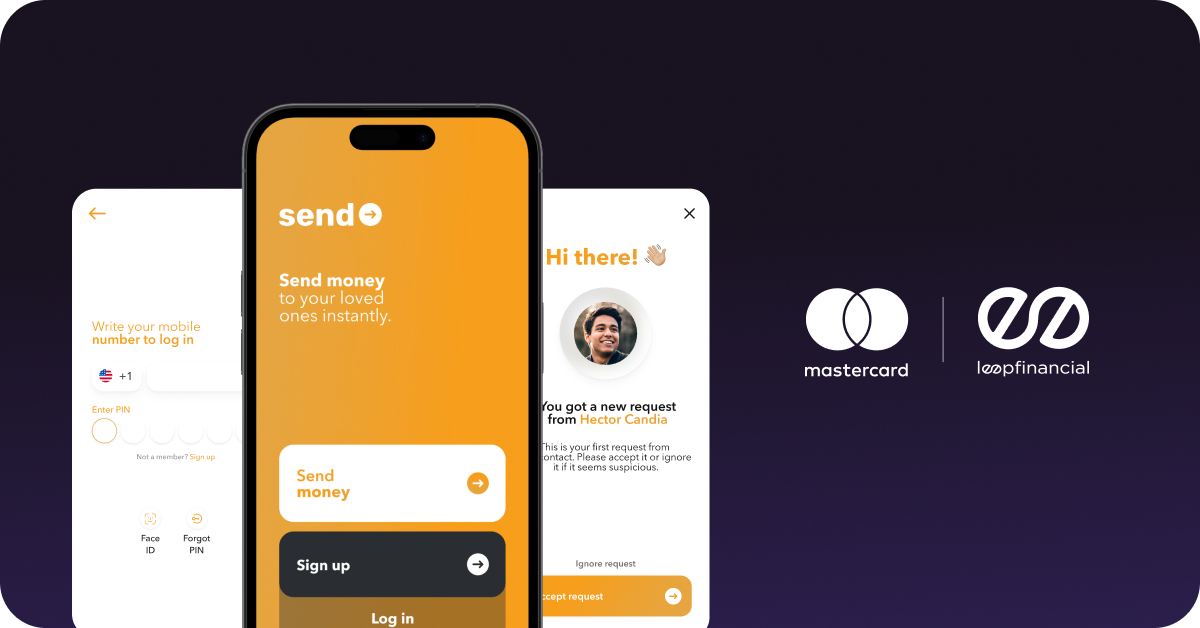

Leap Financial and Mastercard launch embedded remittances services

May 21, 2024 | Miami, FLThis solution enables Latin American banks, fintechs, retailers, and telcos to improve the digitalization of remittances, reducing costs, strengthen financial inclusion and enhance the consumer’s user experience.

Leap Financial, a company at the intersection of fintech, AI, and cultural insight, has partnered with Mastercard to launch an Embedded Remittance service. This comprehensive white-label solution allows financial and non-financial entities to place a “request remittance” button into their offering to tap into the remittance flows from the U.S. to Latin American and Caribbean countries, capitalizing on a $155 billion market, as reported by the Inter-American Development Bank. The partnership is set to transform the remittance landscape by leveraging digital solutions to make remittances more accessible and affordable, contributing significantly to financial inclusion.

Leap Financial and Mastercard are directly advancing the digitalization of remittances, providing benefits and convenience to both senders and receivers. Leap Financial enables its clients to initiate remittances from the sending end, offering a scalable and flexible solution that accommodates the culturally entrenched habit of cash deposits. This is achieved through a network of 85,000 U.S. retail locations, including pharmacies, supermarkets, and convenience stores, all equipped with state-of-the-art security and compliance technology. Mastercard ensures that beneficiaries can access their funds reliably and securely, leveraging its global payment network. Together, they streamline the remittance process, providing essential services tailored to the needs of diverse communities.

The partnership introduces LOLA, an AI-based virtual agent that facilitates remittances through voice and text commands on popular messaging platforms like WhatsApp. This visionary use of AI makes remittances more inclusive and accessible, especially for populations less familiar with traditional banking systems. LOLA can also provide financial education when prompted. Additionally, leveraging Mastercard's global network, this embedded remittance solution offers white-label models integrated with and tailored for banks, fintechs, merchants, telcos, and payment agents, ensuring broad industry coverage and inclusive reach.

In addition, to accelerate the digitalization of international remittances to Mexico, Leap Financial partnered with Arcus by Mastercard, to leverage Arcus’ role as a direct participant of the Mexican Interbank Electronic Payment System (SPEI), enabling funds disbursement to any bank account, wallet, credit or debit card 24/7 instantly. This partnership significantly reduces the cost of remittance, making it more affordable for millions of people to send money home, thereby supporting the economic well-being of communities across Mexico.

Leap Financial’s Embedded Remittance ecosystem, now enhanced by its collaboration with Mastercard, boasts over a dozen partners, including retailers, fintechs, payment processors, gateways, and banks. The Embedded Remittance solution features:

• End-to-End Customer Visibility: Receiving Partners in Latin America gain visibility into sources of funding to and can integrate accurate reporting to local authorities.

• Digital Borderless Money Flow: Remittances from the U.S. are funded through debit cards, credit cards, digital wallets, or cash at over 85,000 retailer locations. Funds are instantly delivered to new or existing customers' bank accounts, cards, or wallets via their mobile phones.

• 360 KYC + AML: Identities of sending customers are verified within minutes, utilizing robust AML and anti-fraud tools delivers a solid multilateral compliance system.

• Revenue-sharing model: Empowering affiliates to define markups and making remittances faster, more convenient, and cost-effective transfers.

• Low Startup Cost: The white-label solution is designed for easy integration into any business, reducing startup costs, operational complexity, and bureaucratic hurdles.

"Our Embedded Remittance solution revolutionizes how money is sent and received, making it as straightforward as a tap on a mobile app or using voice to interact with Lola, our AI super agent," remarked Lionel Carrasco, Co-Founder of Leap Financial. "This innovation is a bridge connecting families, empowering businesses, and fostering communities across borders. Our collaboration with Mastercard amplifies our capability to redefine the remittance landscape, marking a significant step towards our commitment to financial."

“Whether money is being transferred within a country or across borders, what matters most is that the payment is fast, secure, transparent, and accessible to people when they need it – regardless of their location. Through our portfolio of international money transfer solutions, Mastercard Move, we’re powering a variety of payment experiences that answers to rising consumer expectations,” said Walter Pimenta, Executive Vice President, Products, Latin America and the Caribbean.

This announcement builds on an existing collaboration between the two companies, where Leap Financial offers Mastercard card issuance and processing programs in the United States, enabling and launch a full stack debit and prepaid co-brand card programs for people. Leap Financial is currently offering complimentary executive consultations designed to help Latin American companies grasp the transformative impact that Embedded Remittances contribute to business's success and customer satisfaction through innovation and tailored financial solutions. Visit leapfinancial.com/mastercard for more information or to schedule a personalized consultation call at +1 (844) 487-5652 or email to contact@leapfinancial.com.

About Leap Financial

Leap Financial pioneers the fusion of fintech and AI, transforming financial services and customer interactions. We specialize in Conversational Banking, Embedded Remittances, and Embedded Payments, offering AI-enhanced engagement, efficient cross-border transactions, and integrated end-to-end payment solutions. Our custom, embedded or white label solutions, orchestrate a financial, technology and AI network of companies, to optimize conversion and eliminate friction at every step of the customer journey. Leap Financial has more than 20 partners including processors, payment gateways, fraud detection and lending allies among many others, and has the trust of a wide range of banks and other regulated entities in multiple countries. Our mission is to empower businesses with innovative, inclusive technologies, to help them financially connect 600 million people in the US and Latin America. Leap into a new era of financial and customer interaction innovation by visiting leapfinancial.com

About Mastercard

Mastercard powers economies and empowers people in 200+ countries and territories worldwide. Together with our customers, we’re building a sustainable economy where everyone can prosper. We support a wide range of digital payments choices, making transactions safe, simple, smart and accessible. Our technology and innovation, partnerships and networks combine to deliver a unique set of products and services that help people, businesses and governments realize their greatest potential.