Helping kids save money and build financial confidence, $1 at a time

August 26, 2020 | By Kristin KloberdanzFive years ago, Tanya Van Court’s daughter, Gabrielle, was about to turn nine. For her birthday, she asked for a bike — and an investment account. Her mom had her do some extra chores around the house, telling Gabrielle that if she could save $100, Van Court would match her $100 and set up an account. When her birthday rolled around, Gabrielle had saved only $35. At the same time, she received a number of gifts from relatives that she simply didn’t want or need.

Out of that moment of frustration an idea was born. Van Court thought, what if I get other kids to think about money in the same way? What if, instead of getting gifts they don’t want, kids could ask friends and relatives to contribute to a fund to help them save for the things they really wanted?

“And then I realized, wow, I don’t think anyone is better equipped to do this than me,” Van Court says with a laugh.

Van Court had worked at Nickelodeon for six years in digital strategy, helping devise and design programs that were entertaining and educational for children. “It was all about bridging gaps,” she says. “If a kid with a single parent who has two jobs has no choice but to watch Dora all day long on TV, I wanted to make sure that kid is just as ready for preschool as other kids with full-time nannies who are teaching them things.”

After Nickelodeon, Van Court moved to Discovery Education, where she marketed digital textbooks and created captivating content for kids, embracing the notion that learning can be fun and fun learning can be effective.

Her daughter’s birthday wish got Van Court thinking about a money-saving app for kids. “And then I talked to so many parents who wanted even more: a real savings account, an allowance, financial literacy and a debit card for older kids,” she says. “And they wanted it to be fun!”

In 2016, Van Court launched Goalsetter as a website and entered an accelerator program to get initial feedback. Separately, she spent time surveying parents on what they wanted for their kids. The next year, Van Court found a banking partner, Evolve Bank & Trust, and built the app, which launched in 2019. The company continues to raise investment funding to keep updating and building its app, while donating 5% of its revenue to children’s charities.

Van Court, who is Black, says she wants to reach Black children specifically with this app. She points out that kids with savings accounts are six times more likely to go to college and four times more likely to own stocks, yet the Black community is projected to have a negative net worth by 2053. “We are at a place in America where the wealth gap is a chasm,” Van Court says. “I don’t see us reversing this trend with 40-year-olds, but we can begin reversing it with Black kids by making sure everyone has a savings account.”

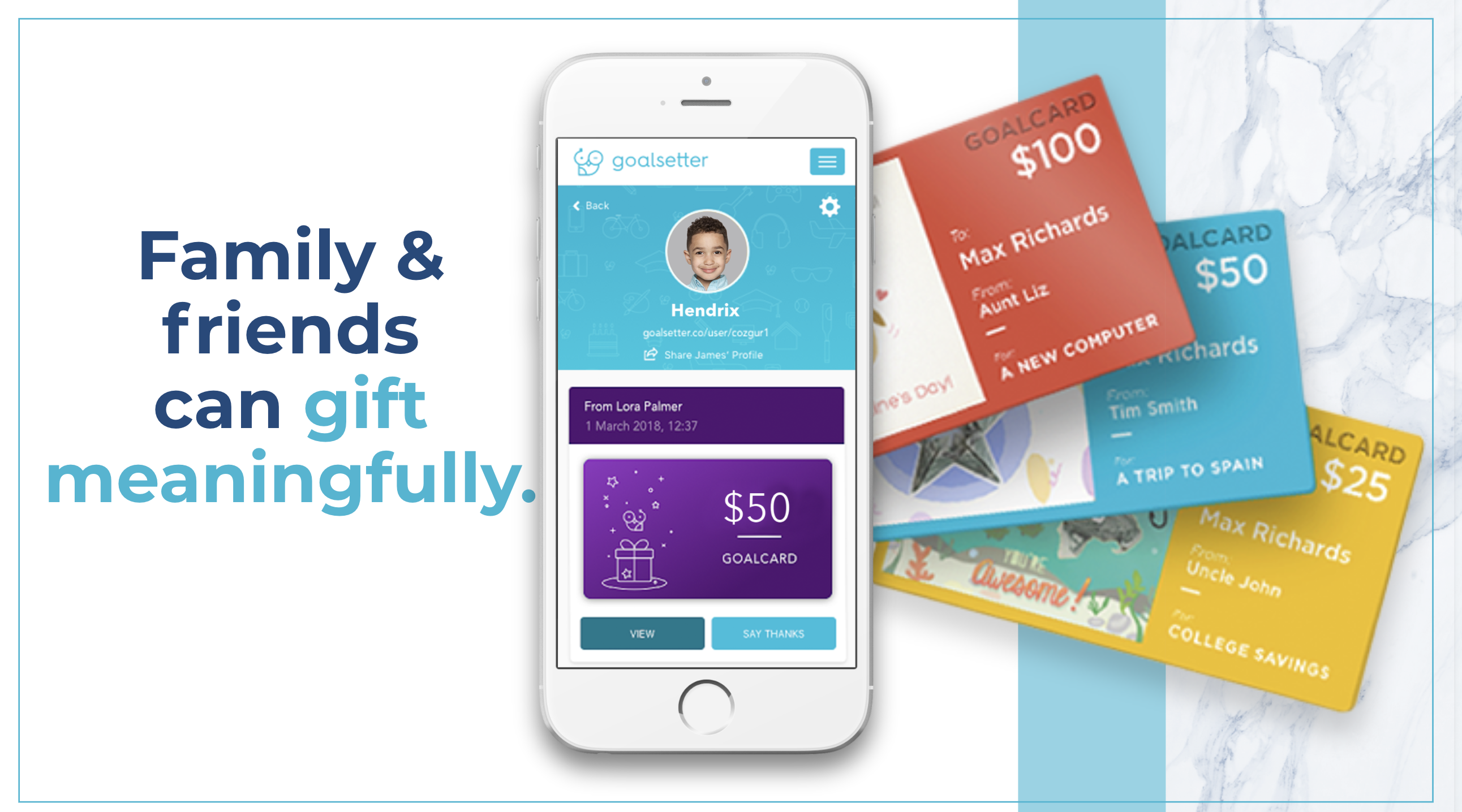

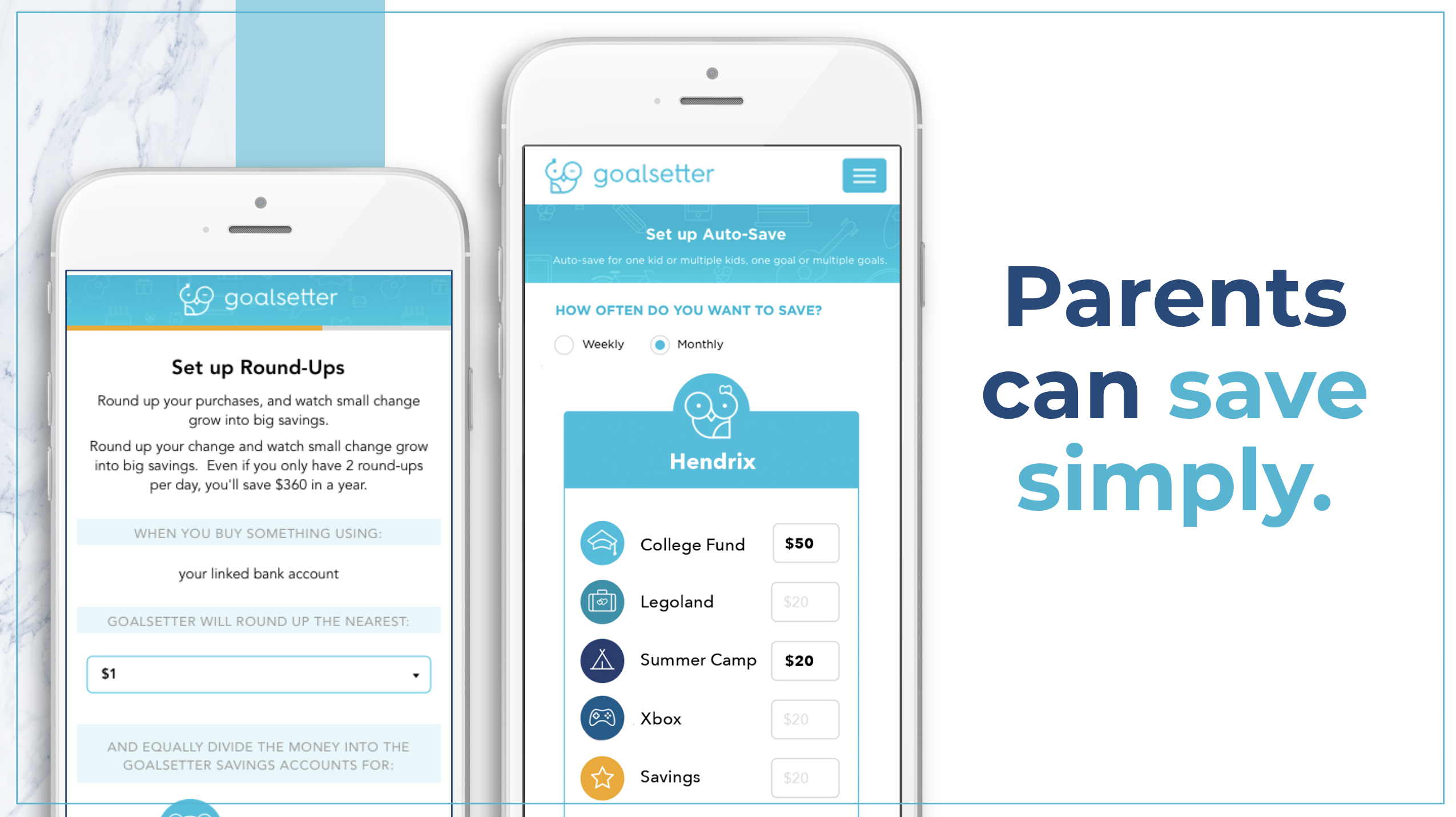

On the most basic level, Goalsetter helps children (and their parents) see what’s in their savings account at any time. Parents can set up regular allowances. Kids of all ages can establish goals for purchases and see how they are doing. They can bucket money into saving, spending and sharing, and their parents can even “round up” their purchases to the next dollar so that extra money goes into savings. Friends and family can contribute to these goals — or to their savings account, just by linking to the app.

By the end of summer, there will be a companion Mastercard debit card called Cashola for older teens where they can make peer-to-peer payments. Everything on there is protected with encrypted security and insured by the FDIC.

But this is no boring bank account app. Remember how Van Court educated all those kids while they were watching “Dora the Explorer”? She has taken those learnings to Goalsetter, which is part of Mastercard’s startup engagement program Start Path, helping startups make connections and access the technology and expertise they need for scale.

The app features memes and gifs, hip-hop personalities and pop culture references — making learning about money a lot of fun, Van Court says. “A little girl was recently interviewed on ABC about Goalsetter and she said she loves how the app is teaching her things about money she never knew she should know, like frugality and compound interest.”

On Juneteenth (June 19) of this year, Van Court launched a nationwide initiative to get 1 million Black children set up with savings accounts. Goalsetter, with the help of popular Black TikTok personalities, is asking banks, financial institutions, large retailers and tech giants to seed accounts for Black children. “Juneteenth is all about freedom from slavery and oppression and lack of opportunity and lack of economic opportunity,” she says. “One hundred and 50 years later, they still don’t have financial freedom.

“What we are bringing to kids and families overall is financial freedom and confidence so parents can have peace of mind that their kid is financially independent, whether they are Black, white, Latino; rich, middle class or poor,” says Van Court, adding that thousands of families are currently using the app. “Our goal is to get Goalsetter and the Cashola card and financial literacy into the hands of all kids in America — because you can’t live the dream if you don’t speak the language.”