The new world of payments is all about change (not that kind)

June 2, 2022 | By Vicki Hyman

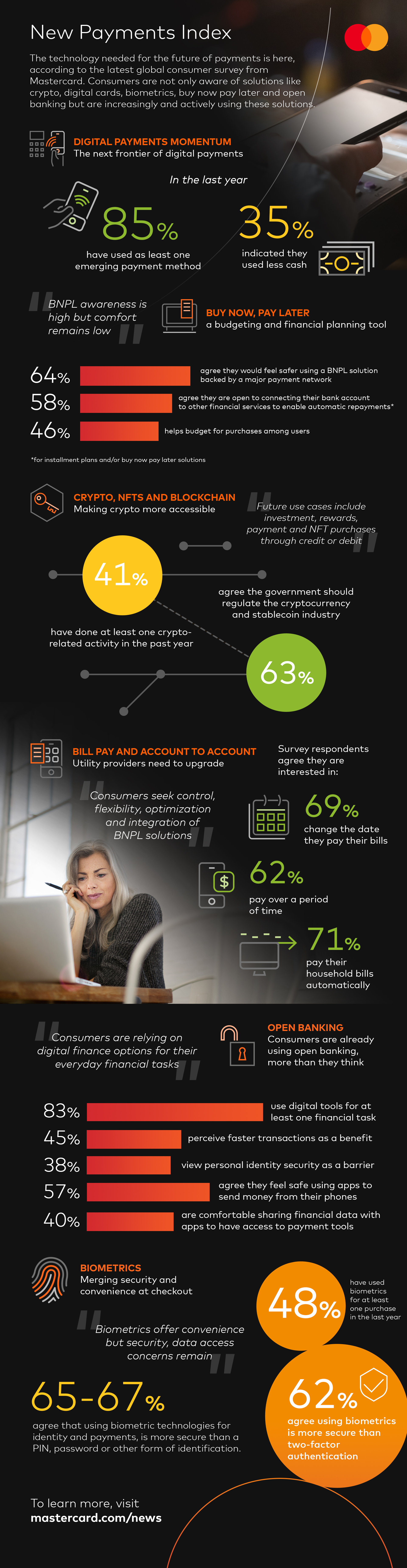

The pandemic accelerated our embrace of digital payments — and that, in turn, appears to have shifted how we think about money, from how we make payments to what we even view as currency, according to Mastercard’s New Payments Index.

Direct bank account payments. Buy now, pay later plans. Money transfer apps. Crypto, QR and wearables payments. Eighty-five percent of people say they used at least one emerging digital payment method in the past year, according to a global consumer survey of 35,040 respondents in 40 countries conducted by the Harris Poll and Mastercard. An overwhelming 93% say they are likely to use one of these methods in the next year.

More than just a snapshot of the shifting landscape of payments, the survey also reveals the motivations behind the momentum toward digital payments, and how considerations such as security, convenience, flexibility and control are directing the digital money revolution. Here are five key insights.

01

Cashing out

There are clear signs that the shift away from cash is continuing. Only about four in 10 millennials and Gen Z respondents report having used cash over the same time frame. Overall, 35% of respondents say they used cash less in the past year, while just over a quarter say they used it more. More than three in 10 respondents haven’t even used currency in some transactions — they’ve paid for purchases using loyalty points, for example.

02

Crypto curious

More than a decade after the launch of bitcoin, cryptocurrency is still mostly seen as an investment vehicle, although 11% report having made a purchase using a digital asset, and 36% say they are somewhat or very likely to try paying with crypto in the next year. The poll — conducted before crypto’s latest drop in value — reveals mixed feelings among consumers: Just more than half feel pessimistic about the value of digital assets, but a nearly equal amount feel they could be good investments. Consumers would like to see more stability in the industry — with 59% agreeing that they would feel more confident about crypto if they knew it was issued or backed by a reputable organization. And 63% agree the government should regulate the cryptocurrency and stablecoin sector.

03

Thumbs up on biometrics

More than two-thirds of consumers agree that using biometric technologies — fingerprints and palm prints, as well as facial and voice recognition — for identification or payments is more secure than a PIN, password or other forms of identification. Overall, 61% agree that it’s easier to pay with biometrics than use a card. It’s not all smiles, though — 71% agree they are concerned about what entities have access to their biometric data, although half of consumers are willing to share it to save time.

04

Linked in

Does anyone balance their checkbook by hand? Better yet, does anyone still have a checkbook? Three-quarters of respondents say they pay their bills digitally, and an additional 14% say they plan to in the future. Fully half of consumers use financial technology for at least five tasks, such as banking, sending money to friends, checking their credit score or financing a loan. Open banking — the ability to share your banking data with other financial service providers — is helping power this shift to digital money management. In all, 71% of consumers agree they would like to be able to make purchases or pay bills directly from their bank account without inputting card details or writing a check.

05

Insights into installments

“Buy now, pay later” has become one of the hottest trends in payments in recent years, with these payments expect to account for nearly a quarter of all global e-commerce transactions by 2026, up from just 9% in 2021, according to Juniper Research. The New Payments Index digs into why people are opting for installments: It helps make unplanned or emergency purchases easier to manage and helps them budget better, for example. Four in 10 respondents say they are comfortable with using buy now, pay later, although more than six in 10 agree they would feel safer and be more interested if a plan came from a trusted provider.

Cash is less critical to younger people, digital payments are a daily occurrence for nearly everyone and even the magnetic stripe is going away. We have reached the moment when payment technologies of the future are no longer hypothetical. Tap, it turns out, was only the tip of the iceberg.

For more information and media inquiries, reach out to Katie Priebe in Mastercard Global Communications at (914) 707-9822 or Katie.Priebe@mastercard.com.