Strength in numbers: How business, government and even kids united to fight cybercrime in 2024

December 19, 2024 | By Christine Gibson

Cyberattacks are as old as the internet, but over the past several years they have become more insidious and destructive, in part by harnessing social engineering at scale and deploying increasingly sophisticated technology like generative AI. This year, cybercrime is projected to cost an estimated $9.5 trillion across the globe — approximately 9% of the world’s GDP.

Criminal tactics are always evolving, so stopping these schemes is an arms race — and, in an ever more interconnected world, a team effort. Staying ahead of the bad guys will take work from all of us. In addition to Mastercard’s agreement in September to purchase global threat intelligence firm Recorded Future for $2.65 billion, here are some of the ways the company has shared its knowledge and expanded its capabilities to help partners, businesses and consumers fight back against cybercrime.

Bringing the boardroom to the cyber battlefield

When cyberattackers strike, the damage can ripple far beyond the financial with criminal and state-sponsored actors attempting to disable critical national infrastructure. Because much of the U.S.’s infrastructure is owned by private entities, the business sector plays a crucial role in civil defense. But corporations shouldn’t be expected to face down high-tech criminals alone. To help directors protect their companies — and their fellow citizens — from cybercrime, Mastercard helped developed a training course, the Cybersecurity Board Academy, in collaboration with partners in the public and private sectors.

In its first session in June, the group brought together corporate directors and government and industry experts at the Secret Service’s James J. Rowley Training Center in South Laurel, Maryland, to explore the state of the art in digital network protection. Participants discussed threats, governance, protection and resilience, building a foundation of best practices for ongoing cyber defense so they are ready for what may come next.

These girls are hacking the future

Training the next generation of cyber professionals is another key to getting ahead of threats. In October, nearly three dozen middle school students from the Young Women’s Leadership School of the Bronx gathered at Mastercard’s Tech Hub in Manhattan to learn about careers in STEM — and to help cyber experts imagine unconventional threats as part of an exercise called Threatcasting, which asks participants — typically much older than these girls — to visualize risks 10 years down the line and figure out ways to disrupt or mitigate them.

“Kids don’t say, ‘That’s not how the world works’ or ‘That’s not how corporate works,’” said Alissa “Dr. Jay” Abdullah, Mastercard’s deputy chief security officer. “They’re full of ideas, and it’s our responsibility to take those ideas and think about how they could materialize in the future.”

Winning the race against quantum cyber threats

In the wrong hands, quantum computers — a new type of computer that relies on subatomic particles to encode information — could shatter the bedrock of digital security. Exploiting the properties of quantum mechanics for unprecedented advances in processing power, these machines crack the encryption codes that safeguard our online transactions and communications. Although quantum computers aren’t yet widely enough available to break cryptographic standards, the race is on to fortify defenses around the world.

That’s why Mastercard launched its Quantum Security and Communications project, modeling new methods for strengthening conventional cryptographic algorithms and using quantum computers to encode data. The results will directly inform future network designs as engineers identify vulnerabilities and test upgrades, helping companies to keep their customers safe.

Combating cybercrime with a bit of military-style preparedness

Even as threats escalate, the cybersecurity industry is facing a workforce shortage. In October, Ron Green, Mastercard’s Cybersecurity Fellow and former chief security officer, offered recommendations about how to close that gap, informed by his years investigating electronic crime for the U.S. Army and the Secret Service and two decades leading cybersecurity efforts in industry. His advice — from practicing good email hygiene to encouraging nations to share wisdom and best practices — emphasized the need to act quickly.

For example, he urged employers to create opportunities for immediate hands-on experience. He also called for national cybersecurity training centers to run real-time scenarios to see how governments, companies and infrastructure providers can maximize their impact in a crisis — because, he said, the secret to combating cybercrime is “good old-fashioned tactical thinking.”

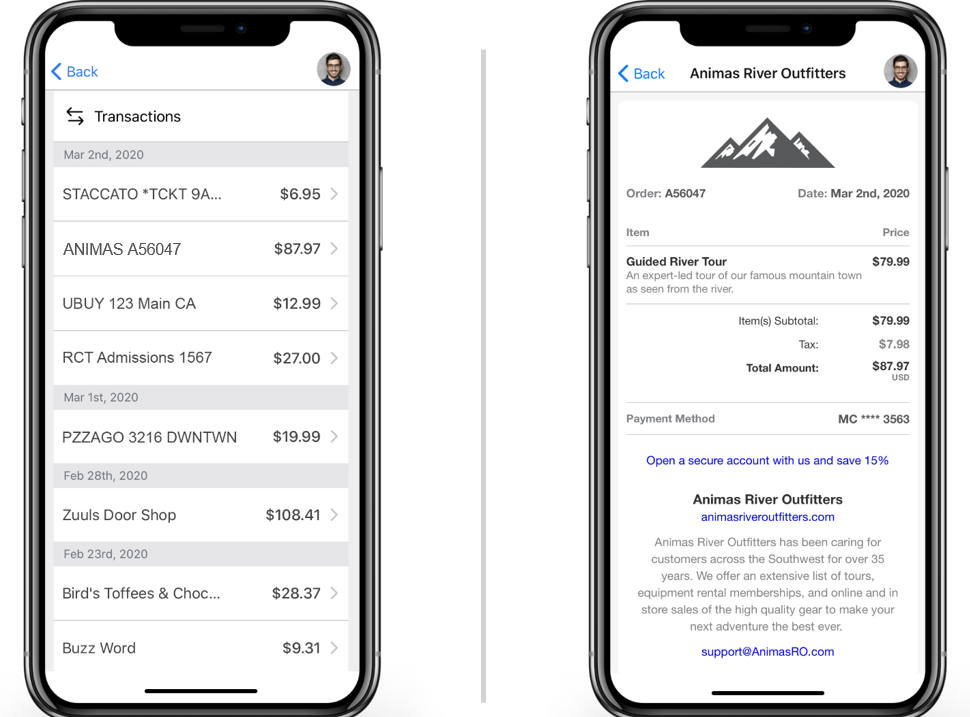

Taking the mystery out of shoppers’ card statements

When you open your bank statement at the end of the month, you’re confronted with a list of merchant IDs that may bear no relation to the names of the businesses you visited. In addition, given the rising number of non-cash transactions, you might not remember all the purchases you made and where you made them, particularly subscriptions that you may have signed up for and subsequently forgotten.

Assuming the forgotten or unfamiliar transactions are evidence of fraud, many customers request a return payment from their bank. Investigating these legitimate purchases is a needless expense for the bank and a waste of time for the consumer.

But the right data can jog their memories. Consumer Clarity from Ethoca, a Mastercard company, provides clear purchase information within banking apps, so consumers reviewing their transaction history can immediately call up more information about the purchase. Consumer Clarity reduces customer service calls, freeing representatives to concentrate on legitimate errors and fraud cases. Mastercard’s recent acquisition of Minna Technologies, a leader in subscription management software, will be integrated with Ethoca’s offerings to better manage the subscription experience for consumers.