Ethoca and Aite Group Research Finds Cardholders Are Eager for Digital Solutions that Deliver Greater Purchase Transparency

June 10, 2020 | Toronto, CanadaTransaction Confusion and False Claims – Both Leading Causes of Disputes and Chargebacks – Shown to be Preventable Through Improved Merchant-Issuer Collaboration

Ethoca, a Mastercard company, today announced the release of new research that reveals cardholders have a strong appetite for digital solutions that provide greater insight into their purchases. These digital solutions will improve customer experience as well as reduce disputes, chargebacks and false claims by delivering in-depth purchase information direct to cardholders through digital channels such as mobile banking applications.

According to the study, 72% of consumers engage with their financial service providers’ website or mobile application at least once a month. This makes the digital channel a critical avenue between them and their issuer – one that cardholders expect more from when it comes to information available on-demand. Furthermore, 96% of surveyed consumers expressed a preference for having more detailed transaction information available to provide increased clarity. The features identified by the 1,000+ surveyed consumers as being most valuable for alleviating transaction confusion are:

- A picture of the printed receipt

- The date and location of delivery for online purchases

- A full list of products purchased

- A link to refund and return details for the purchase

With greater digital dependency, having real-time purchase details is critical for consumers, merchants and card issuers alike. These features not only improve the overall experience for cardholders – who no longer need to hunt for this information – but they can effectively reduce incidents of false claims where a cardholder files a dispute unintentionally.

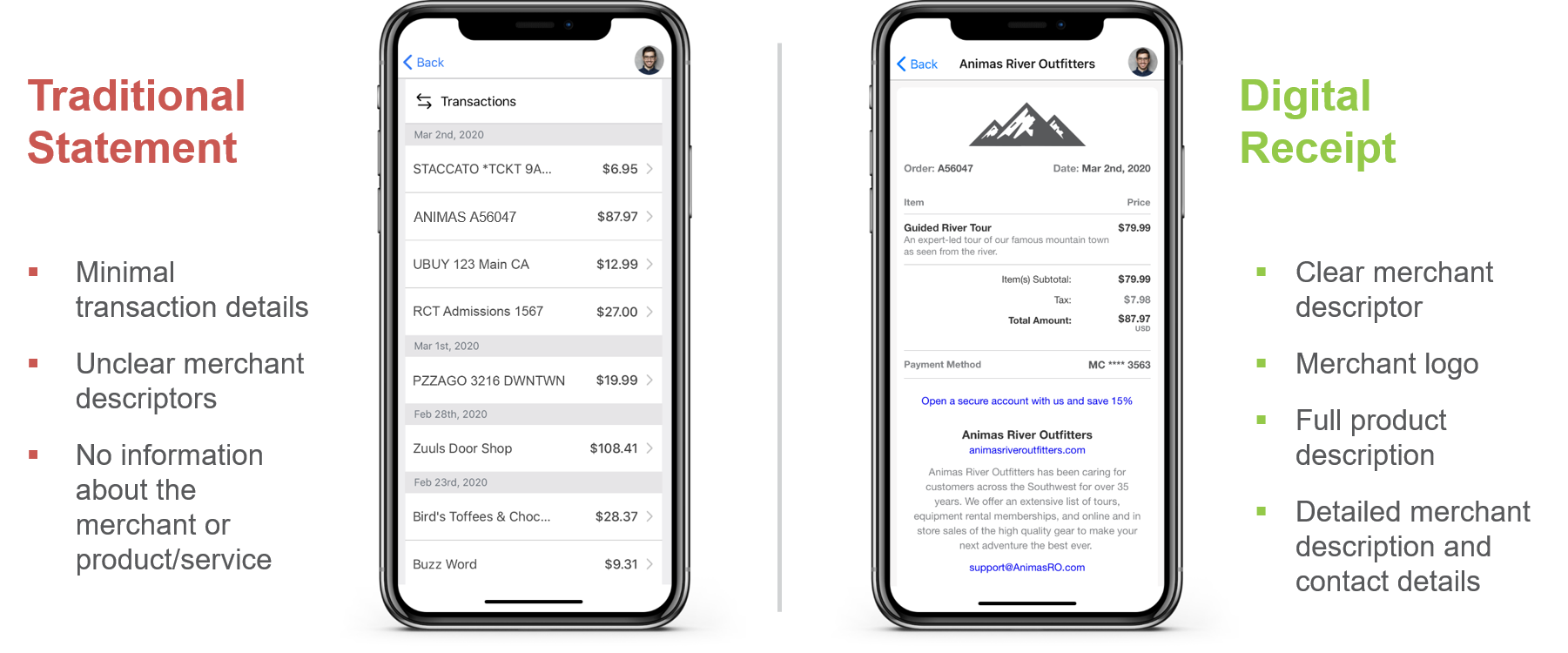

False claims are a significant and growing problem for all stakeholders in the payments ecosystem. For digital goods merchants, rates can reach upwards of 80% and higher. One of the most common reasons: transaction confusion. Cardholders reviewing their online statements often have trouble deciphering the brief, unclear descriptions that accompany each transaction, or they mistake genuine transactions made by other members of their household for fraud. This uncertainty often leads cardholders to contact their card issuer to dispute unrecognized transactions.

The resulting chargeback process is a long and expensive ordeal for all involved – one that is expected to worsen in the current climate and in years to come. According to the report, the cost of chargebacks to U.S. issuers is expected to grow from US$690 million in 2020, to more than US$1 billion by 2023. The report also found that providing additional transaction clarity has the potential to reduce call volume by 25% in cases where the description of the purchase was unclear. In short, providing these features is a benefit to the entire payments ecosystem: card issuers, merchants, cardholders and supporting payment service providers. It creates a competitive advantage by delivering services that cardholders want while lowering the cost of disputes, false claims and chargebacks.

“Ethoca’s collaboration with Aite on this critical research report validates what Ethoca has been hearing from card issuers and merchants for some time – that false claims from confusing or scant transaction information are creating a poor customer experience and driving up dispute processing costs,” said Keith Briscoe, Chief Marketing & Product Officer at Ethoca. “This is the key reason why Ethoca has been laser focused on solving this problem over the last several years with digital receipts and transaction enrichment products. We are continuing to collaborate closely with the largest digital goods providers, retail brands and card issuers globally to ensure every consumer has clarity on the purchases they make through their trusted banking relationships.”

“This study provides timely insights for card issuers, since consumers’ reliance on digital channels has dramatically increased in the wake of the pandemic,” said Julie Conroy, research director with Aite Group. “It is more important than ever for issuers to be able to facilitate user-friendly self-service capabilities. The provision of detailed transaction information in the digital channels and call center is an important underpinning of any digital dispute capability.”

Other key findings include:

- 27% of consumers report that, once they connected with their financial institution, the charge wound up being correct.

- A merchant interviewed said they are seeing a 65% deflection rate among issuers that leverage collaborative solutions to display enhanced transactional details. A ‘deflection’ occurs when clarifying purchase detail is successful in giving the cardholder the information they need to avoid pursuing an unnecessary fraud claim.

To download a copy of the full report, please visit https://hs.ethoca.com/aitereport

For an in-depth look at the findings of the report, and a walkthrough of what they mean for all stakeholders in the payments ecosystem, join Keith Briscoe and Julie Conroy for their upcoming digital session during Mastercard’s Virtual Cyber & Risk Summit on Wednesday June 17, 2020.

For more details on how consumers can best navigate billing disputes in the COVID-19 era, visit the Mastercard Content Exchange.

About Ethoca

Ethoca is the leading, global provider of collaboration-based technology that enables card issuers, ecommerce merchants and online businesses to increase card acceptance, stop more fraud, recover lost revenue and eliminate chargebacks from both fraud and customer service disputes. Through the Ethoca Network – the first and only of its kind in the industry – we are closing the information gap between card issuers and merchants. This unique capability makes fraud and customer dispute insight available and actionable in real time.

Our suite of services delivers significant revenue growth and cost saving opportunities to more than 8,000 merchants and 5,000+ card issuers in 70+ countries. Seven of the top 10 North American ecommerce brands, nine of the top 10 North American card issuers and 10 of the top 15 UK card issuers rely on Ethoca solutions and the network that powers them.

Ethoca was acquired by Mastercard in 2019.

To learn more, please visit www.ethoca.com

Media Contacts

Scott Girling-Heathcote

Senior Account Manager

SkyParlour

scott@skyparlour.com