Mastercard SpendingPulse: Canadian consumer spending increased +7% in August ahead of back-to- school

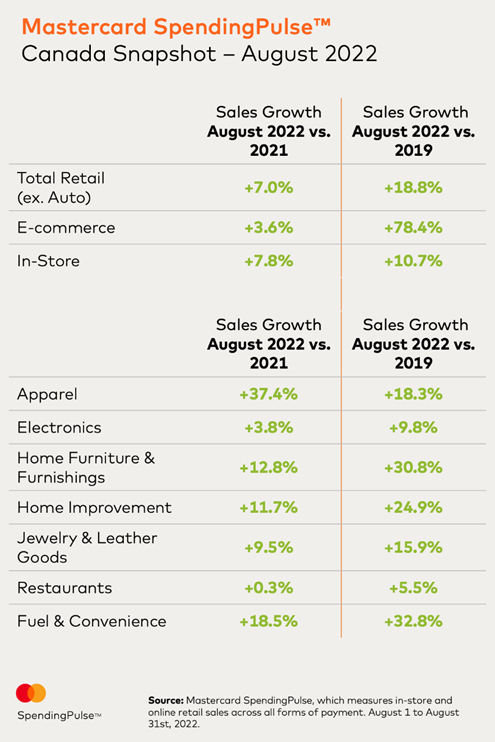

September 14, 2022 | TorontoAccording to Mastercard SpendingPulseTM, which measures in-store and online retail sales across all forms of payment, Canadian spending, excluding automotive, increased +7% YOY in August (+18.8% YO3Y), indicating spending has well surpassed pre-pandemic levels. Mastercard SpendingPulse accounts for nominal spending and is not adjusted for inflation. In-store sales increased (+7.8% YOY) with a significant surge in Apparel (+37.4% YOY) ahead of back-to-school season. Fuel and Convenience also saw an increase (+18.5% YOY), as consumers took their final summer road trips.

“As Canadians rounded out their summer with last minute vacation plans and families preparing for back-to-school season, it’s not surprising to see both an increase in retail sales and in-store spending,” said Steve Sadove, senior advisor for Mastercard and former CEO and Chairman of Saks Incorporated. “However, where we continue to see strong growth compared to pre-pandemic times is in the e-commerce sector, indicating new spending habits have set in despite the return of accessibility to in-store shopping.”

Spending growth in August 2022 compared to the levels seen in August 2021, when there were still some COVID-19 restrictions, reflects a return to pre-pandemic consumer behaviour. Of note:

- Back-to-School season is in full force: With the removal of most COVID-19 restrictions and students returning to the classroom, the Apparel sector saw sales increase +37.4% YOY (+18.8% YO3Y), indicating not only seasonal growth, but also a return to pre-pandemic levels of growth as consumers return to in-store shopping.

- Home Improvement alongside Home Furniture and Furnishings sales climb as summer closes out: Home Furniture and Furnishings continued to see growth with sales up +12.8% YOY (+30.8% YO3Y) with Home Improvement sales up +11.7% YOY (+24.9% YO3Y), a consistent trend since the start of the pandemic.

- Last minute travel plans have consumers continuing to spend at the pump: With summer coming to an end and gas prices softening, last minute road trip plans remained top of mind for Canadians with Fuel and Convenience spending up +18.5% YOY (+32.8% YO3Y).

About Mastercard SpendingPulse

Mastercard SpendingPulse reports on national retail sales across all payment types in select markets around the world. The findings are based on aggregate sales activity in the Mastercard payments network, coupled with survey-based estimates for certain other payment forms, such as cash and check.

Mastercard SpendingPulse defines “Canadian retail sales” as sales at retailers of all sizes, excluding automobiles. Sales activity within the services sector (for example, travel services such as airlines and lodging) are not included.

About Mastercard

Mastercard powers economies and empowers people in 200+ countries and territories worldwide. Together with our customers, we’re building a resilient economy where everyone can prosper. We support a wide range of digital payments choices, making transactions secure, simple, smart and accessible. Our technology and innovation, partnerships and networks combine to deliver a unique set of products and services that help people, businesses and governments realize their greatest potential.