Mastercard accelerates sustainable card efforts

April 5, 2023Mastercard today announced it is accelerating efforts to remove first–use, PVC plastics from payment cards on its network by 2028. This move further reinforces the company’s sustainability commitments and scales the accessibility of more sustainable card offerings for consumers seeking a way to reduce the environmental impact of their wallet.

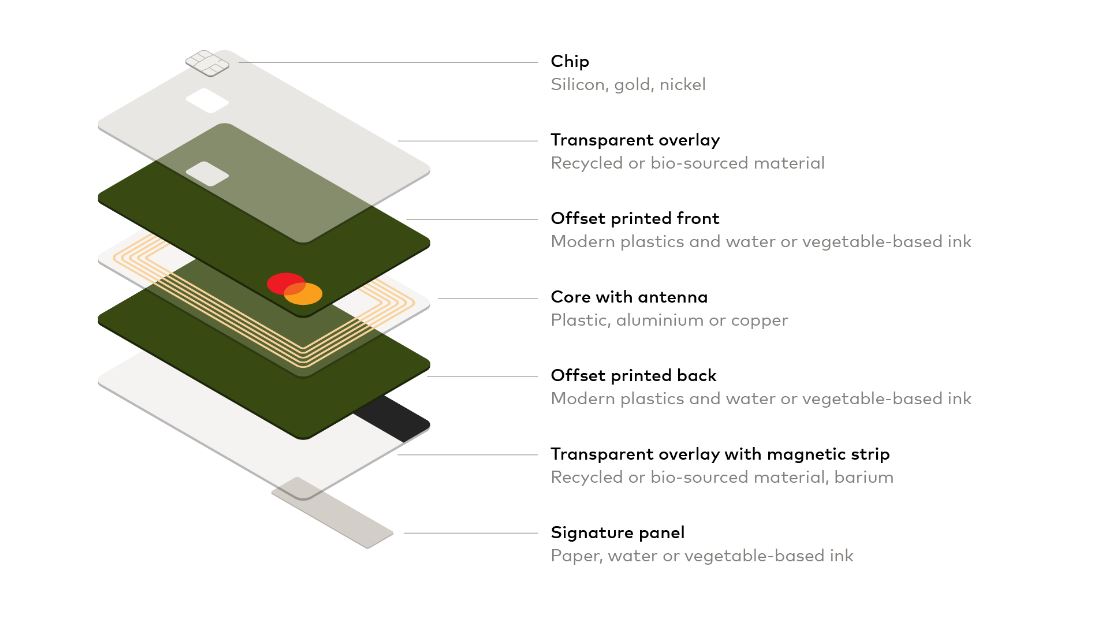

From January 1, 2028, all newly–produced Mastercard plastic payment cards will be made from more sustainable materials – including recycled or bio-sourced plastics such as rPVC, rPET, or PLA1 - and approved through a certification program, in a first move for a payment network. The company will support its global issuing partners through the transition away from virgin PVC.

Mastercard launched its Sustainable Card Program in 2018. Since then, over 330 issuers across 80 countries have signed up, working in partnership with major card manufacturers to transition more than 168 million cards across its network to recycled and bio-based materials. Today’s announcement further accelerates these efforts, while also complementing the company’s work to deliver innovative, digital-first card programs that fully eliminate the need for a physical card offering.

The rule change will see all newly made cards certified by Mastercard to assess their composition and sustainability claims; this certification will then be validated by an independent third-party auditor. Once a card has been validated it can be imprinted with a Card Eco Certification mark.

“At Mastercard we are leading and shaping our industry’s collective pursuit of a more sustainable, more environmentally conscious future,” said Ajay Bhalla, President of Cyber & Intelligence at Mastercard. “As our customers respond to increased consumer desire to make more eco-friendly choices, we are making a firm commitment to reducing our environmental footprint – for the benefit of people, planet and inclusive growth.”

Mastercard established its sustainability efforts more than a decade ago with a focus on financial inclusion, data responsibility and the environment. Through its network it collaborates with partners to bring new environmental innovations and initiatives to market, such as our Priceless Planet Coalition, Carbon Calculator as well as the Sustainable Card.

“Mastercard is committed to advancing climate action and reducing waste by driving our business toward net zero emissions and leveraging our network and scale to accelerate the transition to a low-carbon, regenerative economy,” said Ellen Jackowski, Chief Sustainability Officer for Mastercard.

In 2018, through Mastercard’s Digital Security Lab, the company launched the Greener Payments Partnership with card manufacturers Gemalto, Giesecke+Devrient and IDEMIA to reduce the use of first-use PVC plastic in card manufacturing. Mastercard’s participant banks span more than 80 different countries worldwide. It launched the Mastercard Card Eco-Certification ("CEC") scheme in 2021.

Comments from partner banks:

Taylan Turan, Group Head of Retail Banking and Strategy, Wealth and Personal Banking at HSBC, said:

“Today’s announcement from Mastercard is a huge step for financial services. New sustainable materials, such as rPVC, offer our sector a clear way to accelerate its efforts to build a more sustainable future.

“As part of our net zero strategy at HSBC, we’ve already introduced recycled plastic payment cards across 28 of our global markets and embedded the requirement to use sustainable materials for all debit, credit and commercial cards in our product governance; removing 85 tonnes of plastic that would have ended up in landfill.

“This level of impact couldn’t be achieved without strong partnership; I am so proud for us to be a part of a movement which is gathering momentum across the world.”

Michael Battagliese, Head of Payment Solutions, Senior Vice President at Bank of the West said:

“We believe that conducting business sustainably is simply the right thing to do. That's why we partnered with Mastercard on our 1% For The Planet Checking Account debit cards, which are designed to reduce the impact of first-use PVC on the environment.

“We’re proud to have been one of the first banks in the US to be a part of the sustainable cards program and we’re pleased Mastercard is on a path to make all payment cards with more sustainable materials.”

Helen Bierton, Chief Banking Officer at Starling Bank said:

“This initiative is a welcome next step in the journey to a sustainable future. As one of the first banks to remove first-use PVC from our debit cards, we know how important this is to our customers.”

“We recognise this can only be achieved with strong partnerships and support for the efforts by Mastercard to widen the programme to its entire network.”

Driving a more sustainable future

Tackling the global climate crisis will take all of us. Mastercard can have the biggest impact by activating our global network to create collective action. Through this network, we are collaborating with partners to bring new environmental innovations and initiatives to market, such as our Priceless Planet Coalition, Carbon Calculator and Sustainable Card Program. And we’re partnering across the public, private and social sectors to drive the next generation of climate innovation. Our Sustainability Innovation Lab serves as an R&D center for sustainable digital products and a platform to co-create with partners.

*****

1 rPVC, rPET, or PLA are examples of alternative plastics that are most commonly used in packaging, construction materials, and recycled bottles.

Story

A brief history of the payment card

A card made from corn? That’s just the latest change that may be coming to your wallet. From embossed cards to magnetic stripes to chips to metal cards and more, here’s a look at how the physical payment card has evolved over the decades.

Read moreAbout Mastercard

Mastercard powers economies and empowers people in 200+ countries and territories worldwide. Together with our customers, we’re building a resilient economy where everyone can prosper. We support a wide range of digital payments choices, making transactions secure, simple, smart and accessible. Our technology and innovation, partnerships and networks combine to deliver a unique set of products and services that help people, businesses and governments realize their greatest potential.