Global Open Network Japan Inc. releases whitepaper with Mastercard: How IoT will shape the future of payments

May 28, 2021 | JapanObservation on the merits of IoT to consumers, merchants and the payment industry and the challenges of the payment market.

Global Open Network Japan, Inc. (GO-NET Japan, Location: Chuo-ku, Tokyo, Representative Director and CEO: Shinji Tokunaga), in collaboration with Mastercard (Mastercard, Location: Purchase, New York, USA, President of the Japan region: Yunsok Chang) released a whitepaper based on the joint observation on how IoT could impact future payment. Read more on the whitepaper here.

It is said that over 30 billion devices are already connected to the internet which will grow to be 44 billion by the end of 2021[1]. The advent of 5G and its ability to connect millions of IoT devices will drive consumers become hyper-connected and digital first, which in turn invites development of innovative products and services.

GO-NET Japan, in collaboration with Mastercard jointly has observed the possible benefits that IoT payment could bring to our consumers and also the challenges lying ahead.

This whitepaper focuses on the merits to consumers, merchants and the payment industry as well as the challenges that today’s payment market face and introduces the basic concept of payment platform for IoT use cases using the technology solutions that both provide.

[1] Ministry of Internal Affairs and Communications “Special Theme : Evolving Digital Economy towards Society 5.0”

[Whitepaper outline]

- Merits of IoT

- Pay-per-consumption model using connected IoT devices can enable consumers to participate and enjoy the service more easily.

- Improvements on merchant services by purchase data utilization through connected devices.

- Integration of IoT and payment is expected to bring more benefit to the payment industry.

- IoT related challenges in the payment industry

- Increase of IoT related services and decline in unit prices puts pressure to payment processors’ business.

- Capacity and scalability : two challenges facing the new IoT payment era with large transaction volume.

- Sophistication of cyber threats in IoT payment.

- Rising necessity of security measures for protecting personal information.

- Technology Solutions

-

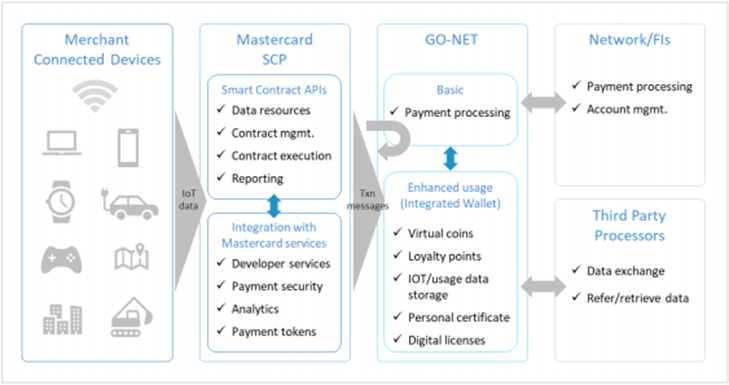

- Mastercard Smart Contract Platform (SCP) enables FIs and fintech partners to build commerce applications to support high-frequency, low-value transactions.

- GO-NET enables partners to resolve issues of capacity and scalability.

- Combination of SCP and GO-NET enables merchants and payment providers to explore new payment methods such as micropayments effectively

[Conceptual diagram of the payment platform for IoT using Mastercard SCP and GO-NET]

GO-NET Japan and Mastercard are both committed to support and delivery of the innovations for our partners, merchants and solution providers with our capabilities and specialty in payment technology to build a better, prosperous future.

About Mastercard (NYSE: MA), www.mastercard.com

Mastercard is a global technology company in the payments industry. Our mission is to connect and power an inclusive, digital economy that benefits everyone, everywhere by making transactions safe, simple, smart and accessible. Using secure data and networks, partnerships and passion, our innovations and solutions help individuals, financial institutions, governments and businesses realize their greatest potential. Our decency quotient, or DQ, drives our culture and everything we do inside and outside of our company. With connections across more than 210 countries and territories, we are building a sustainable world that unlocks priceless possibilities for all.

About Global Open Network Japan, https://go-net.jp/japan/

Global Open Network Japan Inc. is a technology company established in April 1st 2019, providing “GO-NET”, a platform that leverages blockchain technology to support various businesses in areas such as Payment and IoT. GO-NET’s mission is to break the limitation of conventional Payment transactions through Innovative Networks.