Mastercard expands on Wakayama Prefecture partnership to develop solutions to upgrade procurement processes of municipalities

May 8, 2023 | JapanThe expansion of the partnership brings in new partners, Kiyo Bank, Kiyo Card DC, and Mitsubishi UFJ NICOS, in a joint public-private partnership to develop digital payment solutions that will consider legal compliance, expense management processes, and security standards

This version has been roughly translated from Japanese to English, so please pardon the grammatical errors. The original press release was issued in Japanese language here.

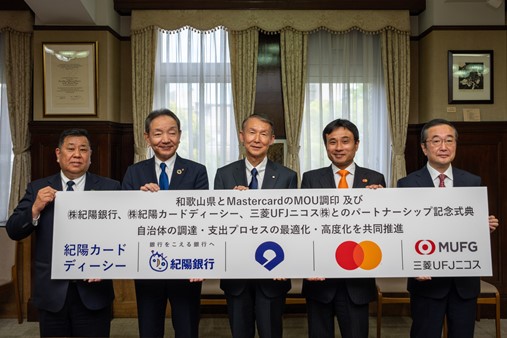

The partnership commemoration ceremony at the Wakayama Governor's Office on Monday, May 8. From left, Takeshi Uetsuchiya*, director, Kiyo Card DC; Hiroyuki Haraguchi, president, Kiyo Bank; Shuhei Kishimoto, governor, Wakayama Prefecture; Ken Uchiyama, country manager, Japan, Mastercard; Hiraku Ishizuka, representative director, Mitsubishi UFJ Nicos. *on behalf of Yoshito Takenaka, President

Wakayama Prefecture, The Kiyo Bank, Ltd., The Kiyo Card DC Co., Ltd., Mitsubishi UFJ NICOS Co., Ltd., and Mastercard have agreed to jointly discuss and develop potential solutions with the aim of upgrading the spending process for municipal goods and services procurement, utility bills, and business trips by optimizing payment methods with a view to introducing card programs.

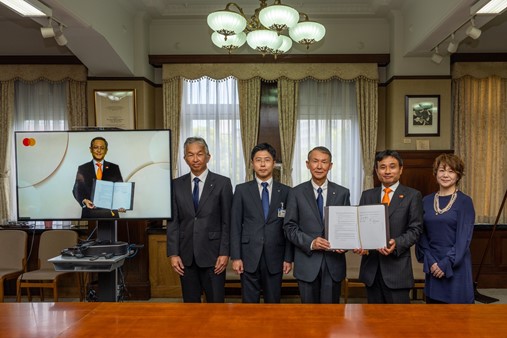

These initiatives with the Wakayama Prefectural Government are a follow-up to the partnership agreement signed by Wakayama Prefecture and Mastercard on January 13, 2022, as the result of continuous discussion between the team from Wakayama prefecture and the Government Engagement team from Mastercard on enhancing the procurement processes. The ceremony was held today at the Wakayama Prefecture Governor's Office and Mastercard Asia Pacific Headquarters in Singapore to commemorate the signing of the additional partnership agreement between Wakayama Prefecture and Mastercard, and the partnership with Kiyo Bank, Kiyo Card DC, and Mitsubishi UFJ NICOS that will support this initiative. It is expected that Wakayama Prefecture's promotion of administrative digital transformation will lead to increased momentum for the promotion of digitalization in the prefecture.

MOU signing commemoration photo. From left, Kok Kee Lim, senior vice president, Government Engagement, AP, Mastercard (Signer); Hideki Sakiyama, accounting manager, Wakayama Prefecture; Akira Yoshimura, general manager, Wakayama Prefecture; Shuhei Kishimoto, governor, Wakayama Prefecture (Signer), Ken Uchiyama, country manager, Japan, Mastercard; Yuki Fujii, director, Government Engagement, Japan, Mastercard

“I am pleased to announce this partnership with such powerful members like Mastercard, a leading global company in the digital economy space, Kiyo Bank and Kiyo Card DC, which support local economic activities with a variety of services, and Mitsubishi UFJ NICOS, which provides one of the best payment systems in Japan for the realization of a cashless society," said Shuhei Kishimoto, governor of Wakayama Prefecture. "I am also glad that we can carry out these advanced initiatives aiming at optimizing and upgrading the procurement and spending processes of municipalities in Wakayama Prefecture. I hope that these initiatives will not only optimize the back-office operations of the prefectural government, but also build an ecosystem that will greatly contribute to the realization of a digital society and the promotion of the local economy.”

“Through its participation in these initiatives, we will cooperate in the enhancement of payment and expenditure processes and the paperless system in Wakayama Prefecture and will support the realization of a digital and cashless society in the region,” said Hiroyuki Haraguchi, president of Kiyo Bank.

“As the entire country promotes the cashless society, Wakayama Prefecture is taking a pioneering role in the development of local communities. It means a lot for us as a local company to be able to participate in this initiative, and we would like to support as much as we can,” said Yoshito Takenaka, president of Kiyo Card DC.

“We are looking forward to working closely together to realize digital transformation, starting with the upgrade of procurement and spending in local governments. With knowledge and experiences in the credit card business that we have cultivated over many years, we hope to contribute to the further development of Wakayama Prefecture and the region,” said Hiraku Ishizuka, president of Mitsubishi UFJ NICOS.

“Through this partnership, Mastercard will reduce the workload of the Wakayama Prefectural Government and promote governance by optimizing various payment operations such as procurement and business trips, billing services, and digitalizing processes from expenses, reimbursement, to existing internal paper-based processes,” said Ken Uchiyama, country manager, Japan, Mastercard. "Mastercard believes that the digital transformation of Wakayama Prefectural Government will lead the entire regional ecosystem, including businesses in the prefecture that are business partners of the local government, move towards being digitalized and paperless. This initiative will back up the partnership formed in January 2022, and allow Mastercard to contribute not only in optimizing supplier transactions via purchasing cards or virtual cards, but also in promoting cashless transactions at the prefecture level that enables domestic and international tourists to make payments safely and seamlessly."

The discussion and development of potential solutions and action plans cover four key areas.

(1) Survey of current municipal procurement processes

- To investigate the current situation, including current budget management, approval processes from order placement to payment, means of payment at the time of expenditure, accounting system environments, acceptance status of supplier cards, procurement of expensive items for which card payment is appropriate, and identify areas for improvement

(2) Discussions on future payment models

- To consider introducing purchasing cards1, virtual cards2, and business travel cards as one of the means of optimizing payment processes in municipalities

- Planning for future payment processes using hypothesis models based on predicted effectiveness

(3) The discussion and development of potential solutions and action plans

- To trial purchasing cards, virtual cards and travel cards in the current system environment

- To examine measures to upgrade procurement and payment processes of local governments and to promote digitalization of small and medium-sized enterprises

(4) Verification of effectiveness

- To verify effectiveness of the potential solutions and action plans qualitatively and quantitatively

【Overview of Partnership Commemoration Ceremony】

Date: Monday, May 8, 2023

Venue: Wakayama Prefectural Governor’s Office

Attendees:

Wakayama Prefecture

- Shuhei Kishimoto, governor

- Akira Yoshimura, general manager

- Hideki Sakiyama, accounting manager

The Kiyo Bank, Ltd.

- Hiroyuki Haraguchi, president

- Tatsuyoshi Yokoyama, director, managing executive officer

The Kiyo Card DC Co., Ltd.

- Yoshito Takenaka, president

- Takeshi Uetsuchiya, director

- Hiroshi Miyashita, director, sales manager

Mitsubishi UFJ NICOS Co., Ltd.

- Hiraku Ishizuka, president, representative director

- Ichiro Katayama, managing executive officer, general manager of business marketing, Division 2

- Mitsutaka Ishigaki, general manager of corporate business planning department 2

Mastercard

- Kok Kee Lim, senior vice president, Government Engagement, Asia Pacific, *joining online from Singapore

- Ken Uchiyama, country manager, Japan

- Yuki Fujii, director of Japanese regional government division

###

1Purchasing cards are digital cards for corporate transactions, which have mechanisms for security and governance. In intercompany settlements, only a card number with an expiration date is issued without the plastic card itself.

2Virtual cards can be issued as a digital supplementary card tied to a primary purchasing card. It is available upon the setting of the terms and conditions of use (maximum usage amount, validity period, hours of use, region/country of use, etc.) for the digital supplementary card.

Media Contacts

Media Contacts

Media Contacts

Media Contacts

About Wakayama Prefecture

In order to deal with medium and long term challenges that the prefectural administration has been facing, such as declining birthrates, large-scale disasters, and infectious diseases, Wakayama Prefecture has been carrying out reforms across the board by improving staff awareness and system operations. These reforms aim for a major shift to a new administration and move ahead with the times.

In the area of administrative digital transformation, we will proactively develop initiatives, such as joint development of potential solutions and action plans, to optimize local government procurement and business travel reimbursement processes, as well as to continue improving the quality of our work and the performance of our organization to shift the nature of government processes to be entirely digital-based.

https://www.pref.wakayama.lg.jp/

About The Kiyo Bank, Ltd.

Established in 1895 (Meiji 28), Kiyo Bank strives to expand its business and improve financial services through community-based sales activities to achieve its goal of serving more people in the community. We hope to support our customers in creating a better future, provide attentive service, and grow together with our customers.

About The Kiyo Card DC Co., Ltd.

Kiyo Card DC provides community-based credit card services as a member of the Kiyo Financial Group. We look forward to the growth of a cashless society as we work with the community to develop an attractive cashless system, and contribute towards the realization of this goal through credit card operations.

About Mitsubishi UFJ NICOS Co., Ltd.

Mitsubishi UFJ NICOS is responsible for providing the services and infrastructure for cashless payment as a core subsidiary of Mitsubishi UFJ Financial Group, Inc. Specifically, we issue credit cards for individuals and corporations, install payment systems for merchants, and issue cards on behalf of financial institutions. With our extensive partnerships and long-standing business expertise, we are committed to meeting a wide range of payment needs for next generation.

About Mastercard

Mastercard powers economies and empowers people in 200+ countries and territories worldwide. Together with our customers, we’re building a resilient economy where everyone can prosper. We support a wide range of digital payments choices, making transactions secure, simple, smart and accessible. Our technology and innovation, partnerships and networks combine to deliver a unique set of products and services that help people, businesses and governments realize their greatest potential.