The future of payments is contactless

June 30, 2020 | By Blake RosenthalThis article was originally published on The Wall Street Journal.

Change is often a gradual process—not a big-bang event—as information, motivation and infrastructure take time to converge.

But as the Covid-19 situation shows, change can happen almost overnight. A handshake becomes an elbow bump becomes a wave across the street. Our dining room tables become our desks. Our living rooms become schoolrooms and a trip to the grocery store suddenly requires personal protective equipment.

As social distancing has become a necessity and the norm, this change is also underscoring the need for touch-free transactions at checkout.

With tap-and-go transactions, people simply hold their contactless cards or contactless-enabled devices, like a mobile phone or smartwatch, directly over the payment terminal. The card or device never leaves the shopper’s hand and there is no person-to-person contact at the point of sale. It’s seamless, secure and quick. Contactless transactions are also up to 10 times faster than chip-based cards, allowing retailers to serve more customers in less time and providing much needed peace of mind for everyone.

Contactless payments technology has been taking hold at varying rates, depending on the market, but its adoption rate is now being propelled as health authorities around the world are calling on people to limit exposure and personal contact.

Between February and March, contactless transactions globally grew twice as fast as non-contactless transactions at grocery and drug stores, according to Mastercard transaction data released last month. In Asia Pacific, the pace was even brisker as contactless grew 2.5 times faster.

Consumer polling by Mastercard in April of 19 countries across the globe shows accelerated and sustained contactless adoption rates. Citing safety and cleanliness, 79% of people worldwide and 91% in Asia Pacific say they are now using tap-and-go payments, while 75% in Asia Pacific say they will continue to use contactless after the crisis is over.

It helps that contactless is already deeply engrained in many markets here. In Australia, 98% of all fast food transactions are contactless. Tap-and-go payments are widely used in Singapore, Hong Kong, New Zealand and Malaysia, with swift uptake in India and steady growth from a low base in China, Japan, Indonesia and Vietnam.

Consumers are growing more accustomed to using the technology for a wide range of purchases—particularly for smaller, everyday payments such as groceries, fast food and vending machines. As a result, the value of all contactless payments worldwide looks set to triple to nearly $6 trillion in 2024 from $2 trillion in 2020, according to a Juniper Research report in February.

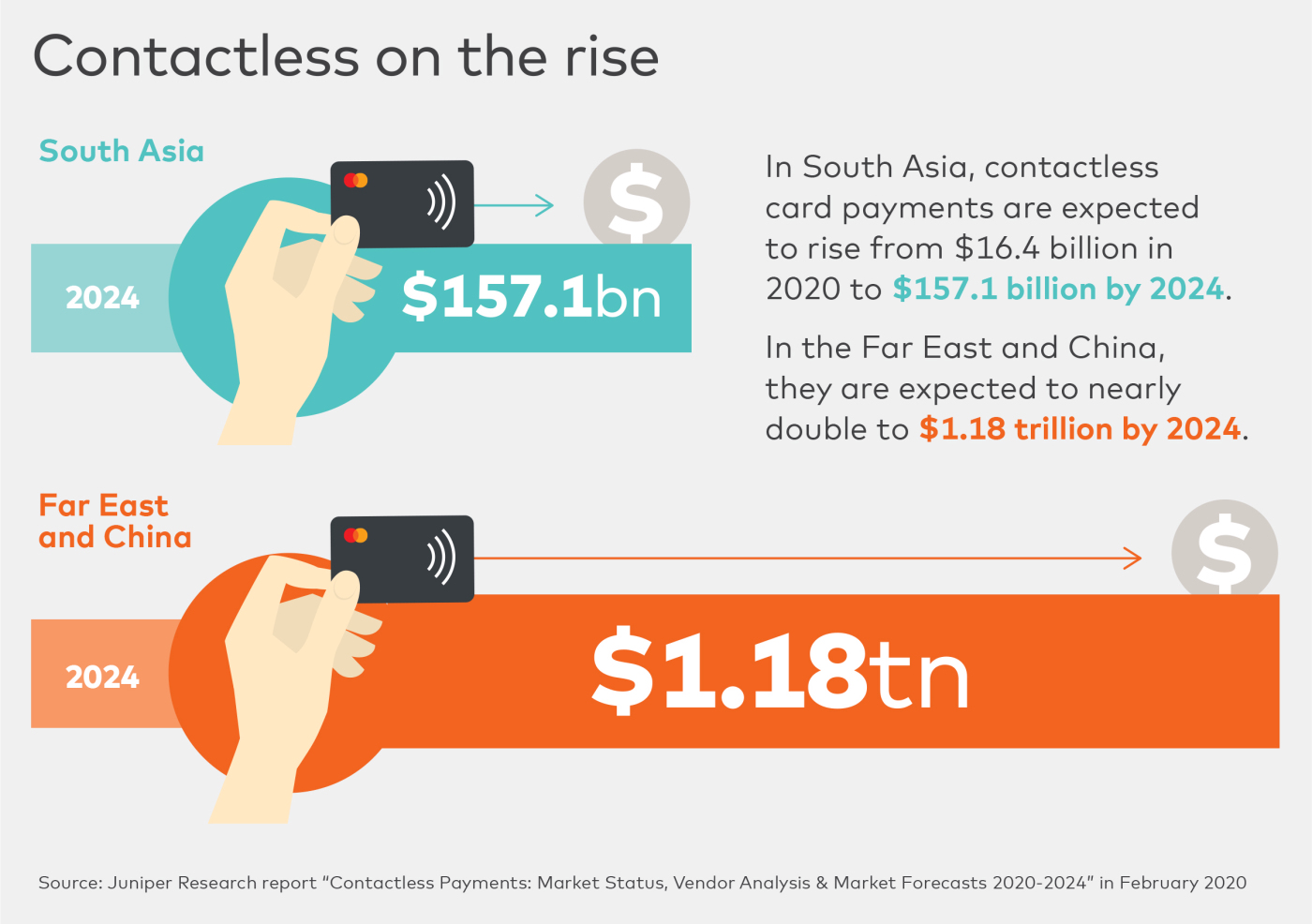

The same report also projects that contactless card transactions in the Far East and China will nearly double to $1.18 trillion in 2024, while contactless card payments in South Asia are expected to rise from $16.4 billion in 2020 to $157.1 billion in 2024.

So how can we accelerate this growth and consumer behavioral change to support safer payments in this time of crisis and beyond?

Mastercard is committed to increasing contactless payment limits—the threshold at which cardholders must provide validation such as a PIN—in more than 50 markets across the globe. In the Asia Pacific region alone, Australia and New Zealand recently raised their limits and the Philippines will join with an increase in July. Already, contactless limits in Singapore, Hong Kong, Australia and New Zealand are comparable and among the highest in the region.

By doubling the limits—and in some markets, we’re enabling increases of four to five times the previous limit—we’re expediting checkout lines for everyone. Merchants and consumers should also know that, since 2018, signatures have been optional for Mastercard payments, further reducing physical contact points and speeding up purchases.

We’re helping our industry partners implement these limit changes quickly and effectively, while sharing best practices to ensure contactless symbols appear on terminals with clear signage that signals to consumers that contactless is welcome.

Another payment innovation will be tap-on-phone technology, which harnesses contactless to give small businesses the ability to easily accept electronic payments from a smartphone. This eliminates the need for costly point-of-sale equipment or additional peripherals and gives those retailers hit hardest by Covid-19 a powerful tool as they look to reopen and recover.

In a world where disruption is the new norm, Mastercard is committed to empowering consumers and small businesses with the tools to skillfully navigate the change—because we know that these days, peace of mind is priceless.