Wallet wisdom: The transformative power of Asia’s ‘Wallet Economy’

September 27, 2021 | By Rama SridharThis article was originally published in the Financial Times.

Recently, some impressive valuations have been reported for digital payments businesses in Asia, many of which are domestic fintech phenomena, barely known outside their home markets.

Through private equity funding rounds, stock market listings and the use of special purpose acquisition companies (SPACs), platform entities such as Singapore-based Grab, Indonesia’s Gojek and Bukalapak, as well as GCash and Paymaya in the Philippines, have caught the attention of investors and are now collectively valued in the multiple billions of dollars.

These payments platforms have grown rapidly by leveraging cutting-edge financial innovation to offer electronic payments, loans, credit cards and other services through their wallet offerings, usually delivered by apps downloaded on mobile devices.

This revolution in digital finance is transforming how consumers and markets operate, empowering businesses and boosting financial inclusion by bringing millions of people into a new, quasi-banking ecosystem in Asia.

According to a report commissioned by Boku, a mobile payments company, the wallet economy in Asia is set to have 2.6 billion users involving over $7 trillion-worth of transactions by 2025.

Wallets will be transformative in their economic power. Mastercard estimates that wallets alone are likely to contribute 0.5-0.75% annually to GDP growth (on average) across Asia’s economies over the next five years. This will happen through a combination of increasing financial inclusion, reducing cash in circulation (thereby increasing the efficiency of business and the public sector) and boosting consumer spending.

To appreciate the impact of wallets, it is vital to examine the factors that will propel their growth. Three in particular, stand out:

First, the wallet economy will continue to grow by 100-200 million people each year as more people use the internet for the first time to engage with payments offerings, displacing the use of cash (which accounts for about 70 percent of transactions across Asia currently). In Southeast Asia alone, more than 40 million people used the internet for the first time in 2020, according to a study by Google, Singapore state investment company Temasek, and consultancy Bain1.

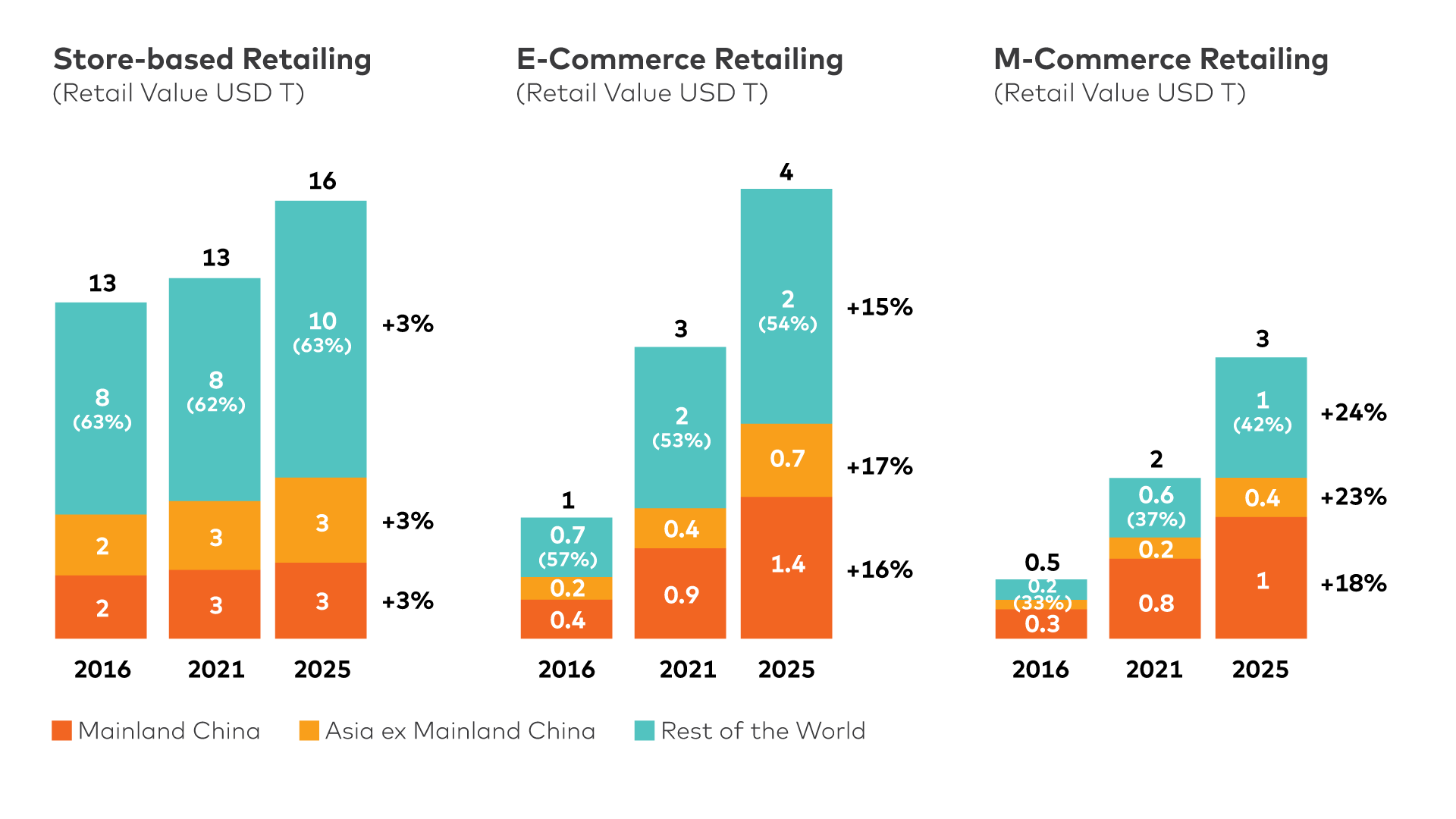

Second, wallets will drive participation in commerce. Asia is set to account for 40 percent of an estimated $13.3 trillion in global retail sales this year, while making up 47 percent of $2.9 trillion in e-commerce transactions, and 65 percent of mobile commerce, worth $1.6 trillion, according to data from Euromonitor2. Mobile commerce itself is likely to grow eight times faster than brick-and-mortar retailing in the region, translating into additional annual spending of $600 billion for the wallet economy in Asia by 2025.

Third, wallet usage and the resulting digitization of the system will continue to improve economic operational efficiency and transparency for governments, regulators, and financial institutions. The World Bank has shown that increased use of digital means of payment also can help reduce the size and impact of the shadow economy, and the growing use of cost-effective solutions like QR codes and adoption of uniform standards for payments will continue to allow wallets to lower costs for merchants, while increasing electronic and trackable acceptance.

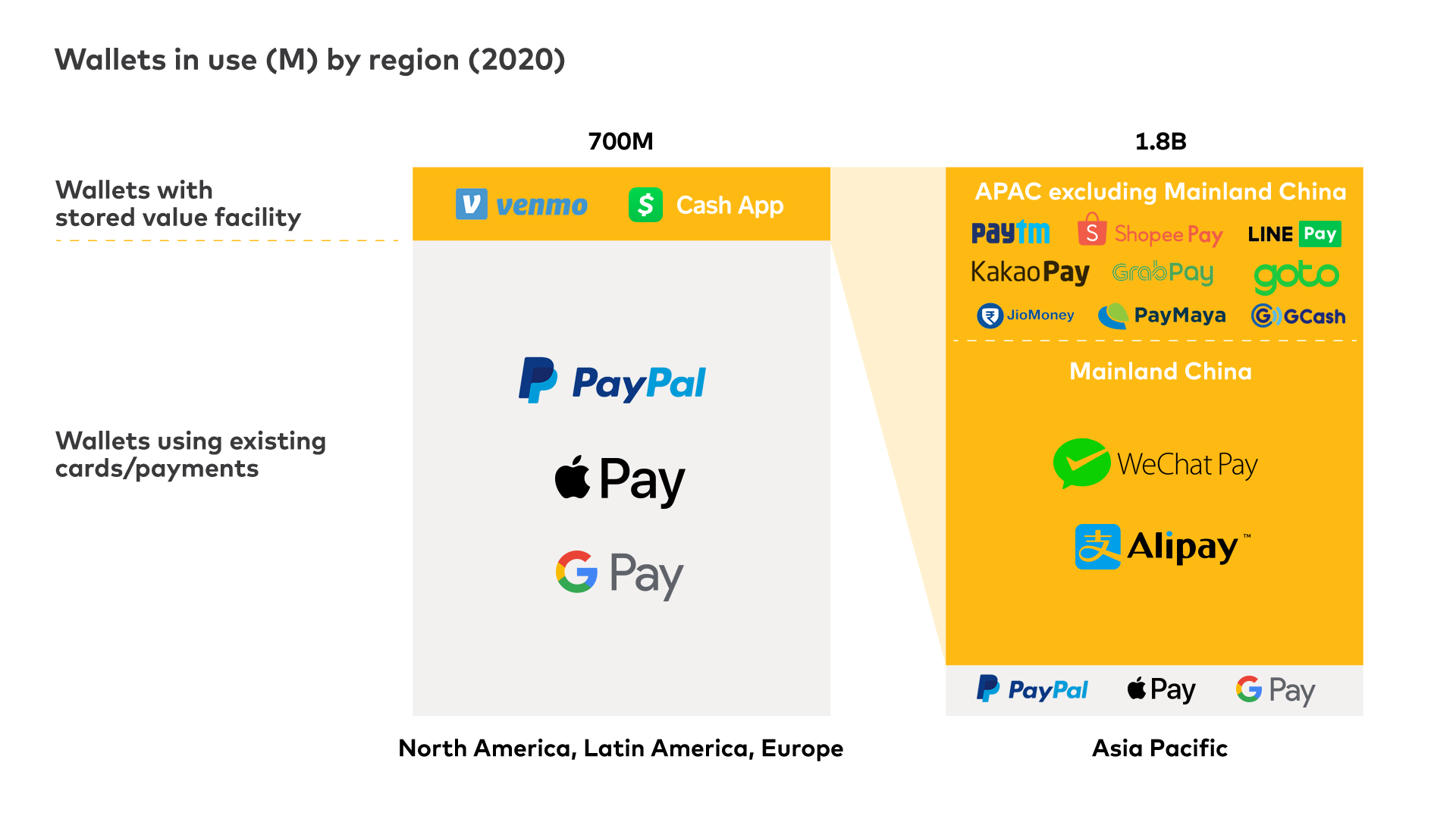

While the overall impact of wallets is incontestable, it is also worthwhile noting that not all wallets are created equal. Asia’s wallet economy provides an instructive contrast to the model that has been developing elsewhere in the world, particularly in the West.

From East to West: How Asia's digital wallet economy differs

Wallets designed and offered by Big Tech in the West have tapped into prevalent payment behaviors, creating a digital interface for the physical payment card that doesn’t require the downloading of an app for payments on the handheld device — unlike the “super apps” that have emerged in China and elsewhere. The safety and security of transactions is ensured by this kind of wallet, while enabling card usage at merchants, where acceptance of cards is nearly universal across small, medium and large businesses.

In comparison, in Asia, the variance and relative unavailability of existing banking and payments infrastructure, coupled with the widespread use of cash, has resulted in a different dynamic and evolution. It has propelled emerging payments businesses — like Grab, Gojek and GCash — to start from scratch, using apps and QR code-based functions to drive scale and access. These businesses have approached the opportunity holistically, offering a range of services from e-commerce to entertainment, social services such as provision of government benefits, to facilitation of remittances and even, in some cultures, delivery of seasonal good luck gifts known as “red packets”. Their appeal is wide ranging, their approach integrated and largely intuitive, while their philosophy is anchored in financial inclusion and broadening access to commerce.

While it is too early to say whether one model will come to dominate the global wallet landscape — each operates according to distinct demographic and economic conditions — it is certainly not too early to explore how each could start to learn from the other.

There is a significant amount of growth left in Asia given the still-high prevalence of cash that could be displaced with digital means of payments. Yet, the much-larger payments profit pool that exists in North America presents an exciting opportunity for Asian wallet providers, given the right circumstances. Any significant move by the West to embrace models that allow open access to key elements like consumer identity for authentication purposes — as laid out in the European Union’s Payment Services Directive and the UK’s “open banking” initiative – could open a critical door for Asian providers to expand their footprints.

There are already signs of western players exploring opportunities in Asia, with a mindful and culturally nuanced approach. For example, Google entered India’s wallet ecosystem in 2017 but its strategy there has been different from how it developed in the West, where it predominantly relied on card networks. In India, Google tapped into Asia’s wallet playbook, connecting to the domestic real-time payments network built on a uniform API standard first, instantly gaining access to customers from multiple Indian banks. It has gone on to offer multiple services on its payment application, including bill payments, donations and its “Nearby Stores” feature.

The age of the wallet economy has definitively arrived. And it is large. While it remains to be seen what influence Asia’s wallet economy may have on the global stage, it is clear that the wallet economy will continue to have transformative power in its home region for many years to come.