What is open banking? Your essential guide

July 15, 2024

Open banking is helping fuel a revolution in financial services.

It can provide people with more convenient ways to view and manage their money and simpler ways to access credit. Open banking can also power different kinds of payment services, such as payments in video games or business accounting apps.

The practice is already helping to widen access to financial services for millions of people and build on the broader introduction of real-time payments and other emerging payment technologies. Open banking is already transforming financial services, with the potential to disrupt traditional financial services providers as more specialized and targeted offerings come online.

It puts consumers and small businesses at the center of where and how their financial data is used, ensuring they control it and that they benefit from it through more choice in the way they pay, manage their money, access credit and more.

But while many of us are already using and benefiting from open banking services, few actually know what’s going on behind the scenes and why it matters. So, what exactly is it?

What is open banking?

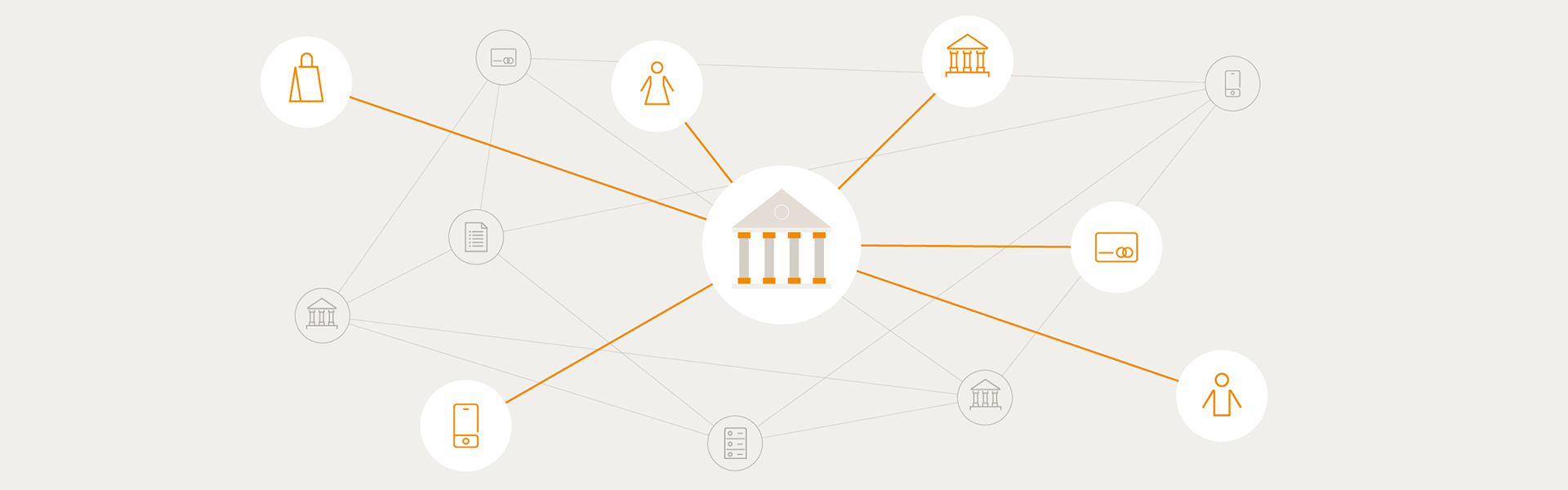

Open banking is the ability to securely share your financial accounts’ data to access innovative financial experiences. Traditionally, only you and your bank could access your financial data. Open banking allows you to share that data with another financial service provider — either a different financial institution or third party, and empowers you to use your own data for your own benefit. Third-party providers can include a wide range of fintechs, currency exchanges, merchants and other digital platforms.

1. allowing access or passage to, or a view through; not closed or blocked

Sharing your bank account data with another provider unlocks new or improved financial services — most often via apps — including those that make it easier to access credit and manage your money in one seamless interaction. It’s a little like the privacy permissions on your phone that allow an app to use your camera or location data, but significantly more robust.

Chances are you already use open banking today, since it’s the mechanism that powers many popular financial tools such as including Experian Boost, the credit building solution, and Bunq, the European neobank app.

What kinds of open banking services are there?

Think about the last time you applied for a loan: all the paperwork involved in proving your eligibility for credit and all the documents you had to gather from various sources. Now, imagine if you could provide that information — your recent financial history — at the click of a button. You can with open banking. It eliminates the need for borrowers or lenders to manually compile, send and verify bank statements and pay stubs and can result in faster, more streamlined applications and lending decisions.

Securely sharing access to your bank account information can also allow you to access new, tailored financial services and give you more control over your data. For example, many of us hold accounts at different banks or brokerages. Open banking allows you to aggregate the information for all those accounts into one real-time dashboard of your choosing, so you can see all your money in one place. It may even make your money smarter: Some financial service providers, such as Bunq, overlay artificial intelligence to provide actionable insights to help you create a budget and manage your money.

In some markets, open banking includes mechanisms for you to allow third parties to make payments from your bank account. This can help maximize rewards, savings and investments, or help avoid overdraft fees by allowing a financial service provider to move money automatically between your accounts. Open banking also can enable a faster and more secure way to make payments online: Instead of having to open your banking app or use another online payment interface, you can make transfers through the service you’re using.

The same or similar service is available for small businesses, too. New tools integrate with back-office systems to allow companies to manage their payments and collections, make real-time bank transfers, and achieve greater visibility over their finances.

Can open banking grow financial inclusion?

Open banking can grow financial inclusion: In certain cases, open banking is bringing digital financial tools to more people, providing small loans and credit for people and businesses who previously couldn’t access these services.

Look no further than people with thin or no credit histories, such as retirees without debt or new immigrants, who face a higher risk of being rejected for new loans. That’s because lenders usually require credit reports with up-to-date information. Open banking can resolve that problem by allowing people to prove they’re creditworthy in different ways — for example, by giving lenders access to your payroll data, your history of regular rent payments or your overall cashflow.

How does open banking work around the world?

Open banking has existed in some form or another for quite some time. But in recent years, the kind of services it enables — from account aggregation to payments — are being embraced by consumers and businesses as companies like Mastercard expand their ability to facilitate this fast, simple and secure data exchange through its open banking services.

In some parts of the world, such as the U.S., open banking has grown from consumer preference for digital experiences. Innovative fintechs have sought to securely access people’s data as a means to provide them with improved and tailored financial services, while banks — themselves recognizing the commercial opportunity — have taken the initiative to develop services to let their customers share their data.

Elsewhere, open banking is often regulation-driven, largely with the aim of stimulating competition and innovation. The best-known example of this is in Europe. There, the EU revised the Payment Services Directive (PSD2), which mandated that all banks starting in 2019 allow their customers to securely share their account information with other financial service providers.

In Australia, regulation goes further — savings accounts, investment accounts and pension accounts are all in scope, with plans to include utility, telecom and travel data connections in the future. This means a financial services provider can offer a person a more holistic view of their finances and a wider range of financial products.

Is open banking safe?

Yes. You control access to your financial data and the specific aspects of data you want to share, along with, of course, who you want to share your data with. If you change your mind after giving a provider permission to access your data, you can revoke your consent at any time.

Trusted financial data aggregation platforms facilitate secure access to your data via traditional connections (enriched with bank-grade security) and APIs, short for application programming interface. APIs make it possible for the software at one company to “plug in to” and access information from the software at another company in real time.

To further improve your security, the industry is moving toward more “tokenized” access, also known as “Open Authorization” or “oAuth” connections. oAuth connections involve providing a third party with a “token” — a coded alternative to your bank account credentials that has no meaningful value if breached.

In regulated markets there are many procedures in place to protect you and your data against potential fraud and loss.

In Europe, for example, third-party providers have to be registered with a national regulatory agency to provide services under open banking. Only registered providers can access your bank account information with your explicit consent, and you can withdraw that consent at any time. Providers also need to prove they meet security and fraud prevention procedures and meet minimum service level agreements so your data is protected.

The introduction of common standards is helping define how peoples’ data is created, shared and accessed. These standards are issued by national bodies and regulators, such as in the U.S. through the Financial Data Exchange, a broad cross-section of banks, fintechs, and financial services groups that have aligned around a single data-sharing standard that could accelerate the adoption of open-banking API frameworks — perhaps globally.

Open banking puts consumers and small businesses at the center of their financial decisions to unlock growth with the promise of more personalized, accessible financial services and enhanced payment choice, putting them on the pathway to prosperity. It not only fosters financial empowerment but also drives economic growth, ensuring that everyone, regardless of their financial background, can participate in the digital economy.

This story was originally published May 5, 2021 and is periodically updated to reflect the latest news in open banking.

report

Open banking and financial inclusion

Learn how open banking can make it easier and more efficient to serve people who are financially marginalized in the report, "Purposeful and profitable: Financial inclusion via open banking around the world."

Download the report