We are working to expand economic opportunity for underserved communities with a customized approach that considers local needs and contexts and is integrated into our business strategy.

As part of our ongoing efforts to build an economy that works for everyone, everywhere, we are committed to supporting underserved communities through fostering inclusive growth and investing in bringing people around the world into the digital economy. This work focuses on empowering small businesses and communities with the tools and resources they need to thrive in today's economy, and it is a key part of our mission to open doors, enable equal opportunities and empower people, both inside and outside our walls. Many small businesses, individuals and communities continue to face barriers to accessing capital and essential financial resources. We are working to make a meaningful impact by focusing on the following areas.

01

Small business growth: Providing access to capital and resources for underserved small businesses

02

Financial inclusion: Expanding access to affordable financial tools and services

03

Community partnerships: Collaborating with local programs to support economic development initiatives

Mastercard Small Business Community

Together with our partners, Mastercard connects small businesses to capital, technology, financial tools, partnerships and more to help grow and protect businesses every step of the way.

Learn more

Social impact for fintechs

Mastercard is building sustainable solutions addressing financial inclusion, economic inequality and sustainable development that boost the bottom line.

Learn more

Master Your Card

Through joint efforts with Mastercard employees and committed industry partners, we enable financial equity for all through access to education, resources and best-in-class electronic payments technology.

Learn more

Start Path In Solidarity

Supporting U.S. startups with underrepresented founders, our Start Path In Solidarity program provides early-stage startups with resources to help grow their business and close the racial wealth and opportunity gap.

Learn moreGreenwood

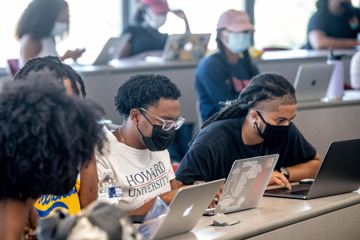

In Atlanta, Mastercard has made a capital investment in Greenwood, a new, minority-owned Fintech founded by Killer Mike, former Atlanta mayor Andrew Young, and Bounce TV founder Ryan Glover, launching a robust mobile-banking program targeting the mass-affluent African-American community. Greenwood’s core mission is to foster new wealth generation and financial education, inclusive of Black and Brown prosperity. Greenwood selected Mastercard as its network of choice in bringing its first financial offering to market. The Greenwood matte black debit Mastercard will provide cardholders a digital-centric user experience along with innovative giveback programs focused on supporting Black and Latino causes and businesses.

Learn more

Goalsetter

Tanya Van Court’s Goalsetter app, launched in 2019, combines a savings account, financial literacy lessons and a Mastercard-powered debit card to help teach children, particularly children of color, how to save and manage their money. Kids with savings accounts are six times more likely to go to college, she says, viewing Goalsetter as a starting point for closing the racial wealth gap in America.

Learn more

MoCaFi

Founded by former Wall Street banker Wole Coaxum, MoCaFi, short for Mobility Capital Finance, extends financial tools and access to credit to people of color who are vastly undeserved in banking. Mastercard has recently invested in the company to help address these inequities and provide alternate financial services to underserved communities with a specific focus on providing tailored digital tools, and new payment cards to low wealth minority and Black communities.

Learn more

Fearless Fund

Women of color are an entrepreneurial force, statistics show, but they receive less than 1% of venture capital. Arian Simone, a former PR powerhouse, closed her company in 2018 to bring more opportunities to fellow women of color by co-founding Fearless Fund, which invests in businesses seeking pre-seed, seed level or series A financing across industries. To help further access to funding for Black women, Mastercard made a capital investment in Fearless Fund. The investment will allow Fearless Fund to further expand their portfolio of women of color-founded and co-founded companies in the consumer packaged goods, food & beverage, beauty, fashion, and technology sectors. The social impact of the investment will also have a significant role in job creation and wealth distribution in underserved communities.

Learn more

Solidarity in Action